Economic Inclusion for Family Wellbeing

HEALTHY CHILDREN & FAMILIES

We must begin all of our efforts to transform systems and policies grounded in the question: What is best for children and families? Prioritizing the wellbeing of families and creating a social contract that recognizes people for more than their workforce productivity can help build toward an inclusive economy. Through this kind of transformational change, we can create a brighter future that lifts all children and families.

A Transformational Vision

At RWJF, we are working to include all families in the economy now and for generations to come. With many allies and partners, we are working toward a new vision—economic inclusion—that prioritizes and serves families. Economic inclusion means overcoming the legacy that undervalues caregivers. It means creating a new social contract that acknowledges our interdependence and recognizes that all families are deserving of wellbeing. That will require institutions to recognize their own responsibility to support the caregivers who are raising the next generation, and to eliminate the structural and systemic barriers that have long excluded and marginalized some families.

A Glimpse at What's Possible

The COVID-19 pandemic shined new light on the links between health and wellbeing, economic security, and structural racism, illuminating cracks in our political and economic systems in ways our nation can no longer ignore. While far from perfect, the collective policy response showed that we can adopt policies that will improve public health, support economic stability, and advance inclusion.

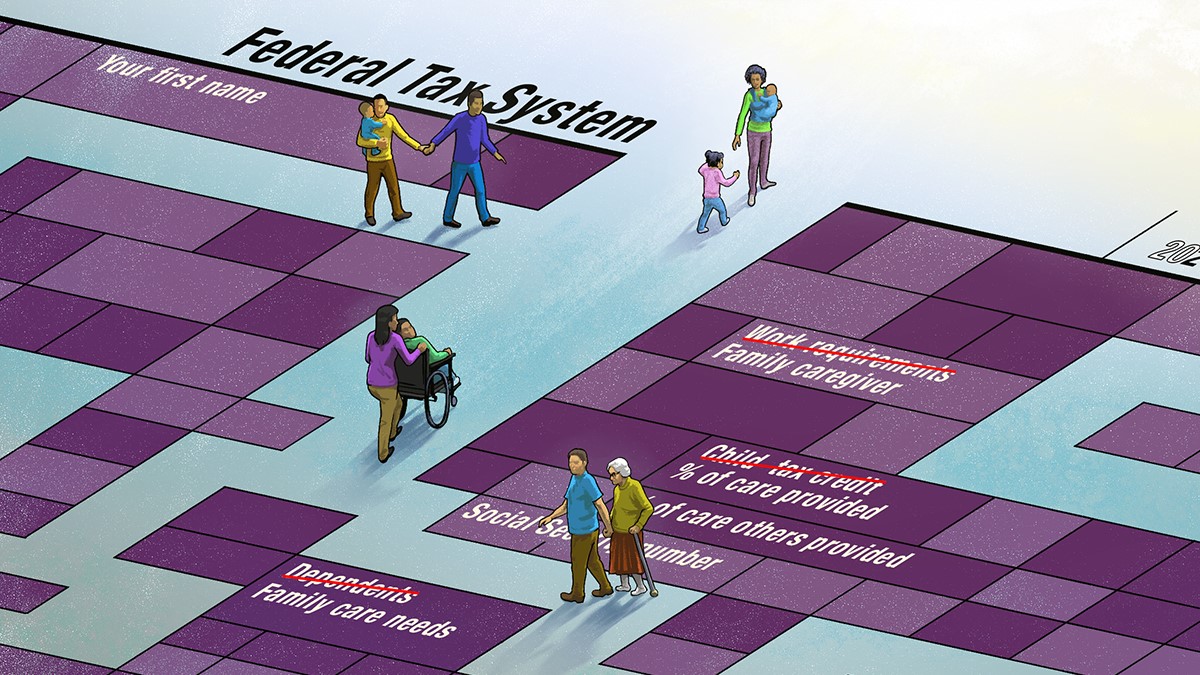

Reshaping the Tax System

Blog Post

Reimagining the Tax System to Strengthen Family Wellbeing

Elaine Maag, one of the nation’s foremost experts on tax and fiscal policy, shares strategies to transform our federal tax system to help all families thrive.

How the Federal Income Tax System Can Worsen Racial Disparities

Funded by RWJF, this data interactive from the Urban-Brookings Tax Policy Center highlights how some federal income tax policies and audit practices exacerbate inequities in wealth and income.

Spotlight: Every Family Forward

Through our project Every Family Forward, RWJF periodically hosts public conversations examining how we can change policies and systems to help all families thrive. Two recent conversations examined how to make equitable shifts to the tax system.

Related Content

Related News and Insights

Read expert perspectives and the latest research from RWJF to explore the opportunities and complexities of this topic.

Scaling Community-Owned Real Estate for Affordable Housing

5-min read

Making Homeownership More Accessible for People Excluded From Opportunity

3-min read

Supporting the Indigenous Finance System on the Mountain Plains

4-min read